Business Services

Page Navigation

Property Tax

-

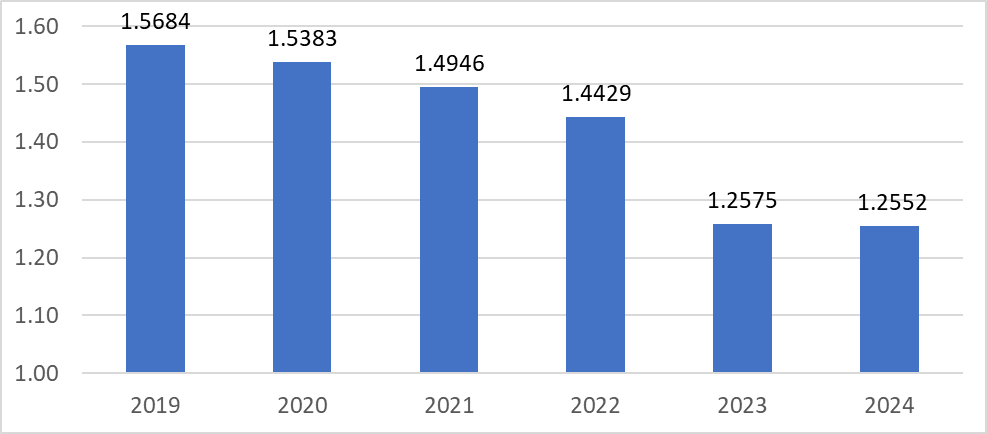

On Monday, September 9, 2024, the Board of Trustees approved a tax rate of $1.2552 per $100 of assessed valuation, $0.0023 lower than last year's property tax rate. Burleson ISD does not set the appraised value of homes.

2020 Tax Rate - $1.5383

2021 Tax Rate - $1.4946

2022 Tax Rate - $1.4429

2023 Tax Rate - $1.2575

2024 Tax Rate - $1.2552 ($0.0023 lower than last year)

The Burleson ISD property taxes are collected by Johnson County Tax Assessor. For information on tax collection and payment methods, please visit the JOHNSON COUNTY TAX ASSESSOR. Property valuation is determined by TARRANT COUNTY APPRAISAL DISTRICT and JOHNSON COUNTY APPRAISAL DISTRICT.